tomado de www.m.dw.com

1508/2017

BUSINESS

Oil-rich but cash-starved Venezuela could be close to bankruptcy

Venezuela might look bad right now amid protests, scarce food and political turmoil. But analysts warn the worsening debt crisis could greatly exacerbate the dire situation - and possibly force a regime change.

Venezuela's long slide into destitution has prompted protests, pillaging and political tensions. But it could soon get a lot worse, according to analysts, because of a debt emergency raising the specter of default.

Defaulting on its debt, estimated at over $100 billion (84.57 billion euros), would cut the oil-rich but cash-starved Latin American country off from capital markets. Lenders could seize assets - tankers, refineries, accounts - belonging to state oil company PDVSA. And the humanitarian crisis could deepen as already limited imported essentials dry up completely and more desperate citizens leave.

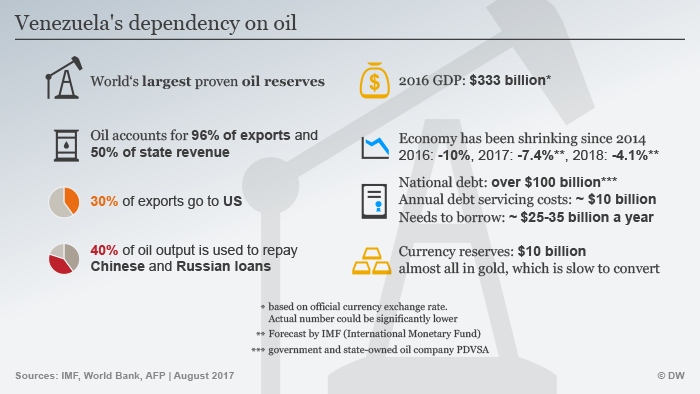

Venezuela, an OPEC member with the largest proven oil reserves in the world, is almost totally dependent on crude oil, which accounts for 96 percent of exports and around half of state revenue.

So far, president Nicolas Maduro's government has gone to extraordinary lengths to service the nation's debt, prioritizing debt repayments over all else, including badly needed imports of food, medicine and other essentials.

But all-important oil production and revenues have been declining, and Venezuela's currency reserves have shrunk to just $10 billion (8.46 billion euros). Most of that is in gold, locked away in Caracas as security for loans.

Together with the low prices - and the 30 percent of output it ships to the United States, its biggest customer - the falling oil production has made it difficult for Caracas to meet its commitments. Venezuela accounts for about eight percent of US oil imports.

According to Günther Maihold, deputy director of the German Institute for International and Security Affairs, only around half of US imports from Venezuela is used for the domestic market. The other half is refined on US mainland by PDVSA's subsidiary Citgo and then re-imported to Venezuela.

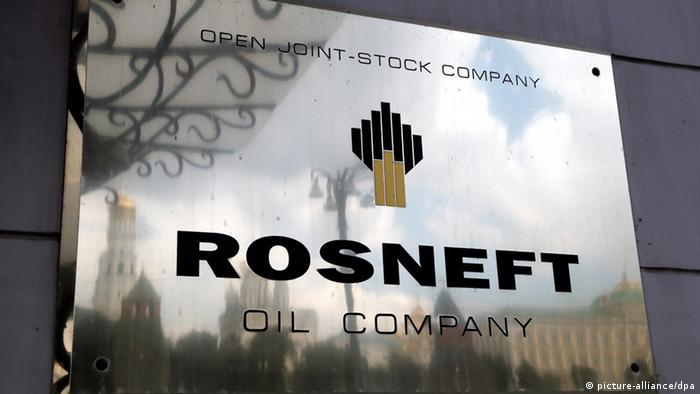

As collateral for Russian credit, the South American nation put up ownership of Citgo, resulting in a 49.9 percent minority stake for Russian government-owned oil company Rosneft.

If a default were to happen, Rosneft could take over Citgo - but that would likely fall foul of US sanctions on Russia. "The US government will not be happy with the idea of having Rosneft taking control of a US-based refiner and fuel distributor," said Juan Carlos Rodado, head of Latin America Research at the Natixis investment bank in New York.

Albeit unlikely, further US sanctions would spell disaster

The legal credibility of Maduro's regime has been put on the line by last month's election of a controversial new loyalist body, the constituent assembly, which has power over all branches of Venezuela's government.

The US imposed sanctions earlier this month, alleging the constituent assembly arose "through an undemocratic process instigated by President Nicolas Maduro's government to subvert the will of the Venezuelan people."

The United States - under whose laws Venezuela's debt contracts are written - does not recognize the assembly. It calls it an "illegitimate" tool for Maduro's "dictatorship" and has imposed sanctions on the president, some of the assembly's members, the PDVSA as well as financial intermediaries.

Researcher Rodado said the assembly "aggravates the reputational risk that already exists on PDVSA and Venezuela bonds."

Many analysts say Venezuela's only option is to renegotiate its debt repayments. But international rejection of the constituent assembly - also by the European Union - may prove an obstacle.

Maihold noted that whereas the US pays cash, Russia and China offer loans for future oil deliveries, meaning Venezuela gets no additional money to service earlier credits. At best, it seems, the deals with China and Russia enable Venezuela to prolong the status quo.

"It is essential that cash flow continues if Venezuela wants to maintain food imports and be able to repay interest for its debt," Maihold told DW.

In a joint paper, two US law experts said there was a "growing consensus that Venezuela will not be able to persist for much longer with its policy of full external debt service," adding this would mean a "debt restructuring of some kind." But holdout creditors would present "a serious, potentially a debilitating, legal risk," they said.

Maihold warned that US sanctions in the form of stopped imports would lead to an "immediate fiscal disaster" and the "collapse of the country", adding that this scenario would only offer one possible escape: additional credits from Russia and China. In the light of recent announcements to limit advance payments, this seems unlikely.

However, Maihold doesn't believe we're "anywhere near" the US stopping oil imports from Venezuela. "I don't think the US would want to be responsible for plunging Venezuela into an even deeper humanitarian crisis."

Venezuela's fate hinges on Russia and China

On Monday, reports surfaced that Russia is securing further access to Venezuela's oil reserves. The news came on the heels of Saturday's PDVSA announcement that its revenues have dropped sharply.

In this context, Russian oil company Rosneft has become an important intermediary to sell the Latin American country's oil on the international market. At least since the beginning of the year, PDVSA has been negotiating with Rosneft behind closed doors about an investment in nine of the most productive oil fields, according to insider information.

Rosneft, Russia's largest oil producer, said in early August it lent around $6 billion in pre-payments to Venezuelan state oil company PDVSA and had no immediate plans to make any further advance payments soon.

Maihold noted Russia's interest in Venezuela is not only of geoeconomic but also of geopolitical nature. "Russia has been trying to push back the US in its own backyard for some time," he told DW.

In April alone, a high-ranking PDVSA employee said, Rosneft paid more than $1 billion in exchange for a promise for later oil deliveries. Russian money has been used on at least two occasions to avoid a payment default, according to the same source.

Neither the two governments nor their oil companies agreed to comment on the case.

Besides Russia, China has been the biggest lender to Venezuela. Between 2007 and 2014, China loaned around $60 billion to Venezuela to be repaid in oil, which was sold for around $100 a barrel at the time. But with oil prices sinking below $50 since 2015 and Venezuela struggling to provide the production needed, Beijing quietly shut off the credit.

It recouped some of what was lent, but is still owed "a great deal," said Francisco Monaldi, an energy policy expert at Rice University's Baker Institute in Texas and director of the Center for Energy and the Environment at the IESA business school in Caracas.

"China is making some sort of imperial outreach Venezuelan oil resources," said Maihold, noting the irony given that "the Maduro government has been criticizing the US for future exploitation of Venezuelan oil fields."

Xi Jinping and Nicolas Maduro at a 2013 meeting in Beijing, China. Around 40 percent of Venezuelan oil exports is used to repay loans extended by China and Russia.

Maihold also said that due to technical issues, PDVSA is ten months behind on its shipments to China, which consequently "might not be very keen to offer additional money." According to analysts, years of neglect have seen PDVSA's infrastructure become rundown and exploration curbed, resulting in said declining production.

To Maihold, the grand question is how much longer Venezuela can go down the "oil for loan" road before Russia and China "lose their patience."

And Alejandro Márquez-Velázquez, an expert on Latin America with the Free University of Berlin, believes due to "lack of reforms and investments in the oil industry and the economy at large," a national insolvency is "a matter of when, not if."

The consensus among experts is that the Maduro regime's desperate efforts to keep the economy artificially afloat is only delaying the inevitable.

Could the debt crisis force a regime change?

Venezuela defaulting on its debt might come about as soon as October or November, when a hefty $3.8 billion in bond payments need to be paid by Venezuela and PDVSA.

Those amortizations "are a challenge, but the government likely will pay," Andres Abadia, senior economist at Pantheon Macroeconomics looking at Latin American issues, said in a July briefing note. Nevertheless, he said, Venezuela was running out of cash and "we expect the situation to get much worse."

"The likelihood is rising that a deterioration of the current recession/near-hyperinflation economic scenario, and the political crisis, will trigger regime change," he said.

But Maihold said talking about a regime change at this point in time is purely speculative. "No one knows who would be in a position to assume power and re-arrange functions of state and private enterprises," he told DW. "It is totally unclear how a transition government would look like."

No hay comentarios.:

Publicar un comentario